Classification of clients in the Astana International Financial Center

INTRODUCTION

Any company that is subject to licensing and operates in the Astana International Financial Centre (“AIFC”) (the “Company”) is required to classify its Clients due to the AIFC CONDUCT OF BUSINESS RULES (the “COB Rules”). A comprehensive classification system ranks clients based on their financial solvency, professional experience and risk tolerance. The classification allows for individualised regulation and supervision, providing the high-level protection and flexibility for different types of clients. On the basis of classification there are also limits on the amount a client can invest or trade on the platform, for example, and knowledge of the classification helps in building a successful business model for the Company. The COB Rules establish minimum requirements for companies to protect clients from risks, losses and warn them of the risks associated with the services provided. A company must always have procedures and controls in place to ensure the COB Rules level of client protection, the level of protection may be higher, but cannot be lower than that set out in the COB Rules.

- TYPES OF CLIENTS

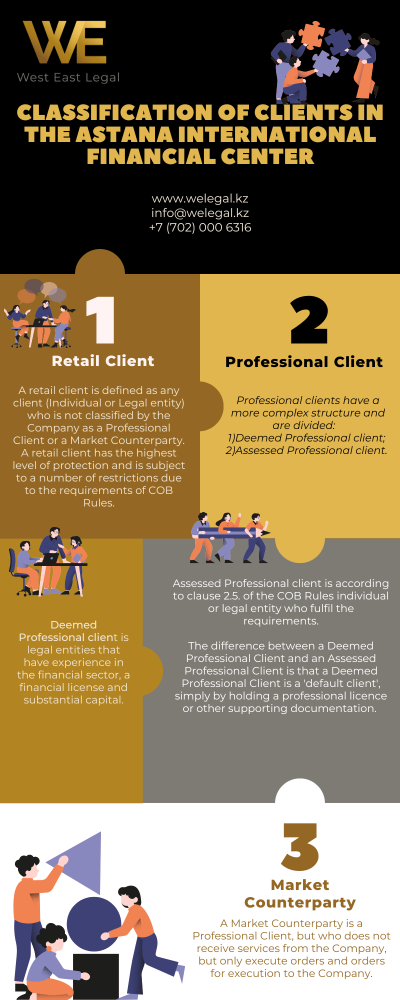

There are 3 types of clients in AIFC according to the COB Rules:

- Retail Client;

- Professional Client;

- Market Counterparty.

1.1. Retail Client

A retail client is defined as any client (Individual or Legal entity) who is not classified by the Company as a Professional Client or a Market Counterparty. A retail client has the highest level of protection and is subject to a number of restrictions due to the requirements of COB Rules.

1.2. Professional Client

Professional clients have a more complex structure and are divided:

- Deemed Professional client;

- Assessed Professional client.

Deemed Professional client is legal entities that have experience in the financial sector, a financial license and substantial capital.

According to clause 2.4. of the COB Rules Deemed Professional clients are each of the following organisations:

- a national or regional government;

- a public body that manages public debt;

- a central bank;

- an international or supranational institution (such as the World Bank, the International Monetary Fund, or the European Investment Bank) or other similar international organisation;

- an Authorised Firm (a Companies that have received a license for a Regulated activities in the AIFC), or any other authorised or regulated financial institution, including a bank, securities firm or insurance company;

- an Authorised Market Institution (a Companies that have received a license for a activity in the AIFC), or any other authorised or regulated exchange, trading facility, central securities depository, or clearing house;

- a Collective Investment Scheme or its management company, or any other authorised or regulated collective investment undertaking or the management company of such an undertaking;

- a pension fund or the management company of a pension fund;

- a commodity dealer or a commodity derivatives dealer;

- a Large Undertaking as specified in COB 2.4.2;

- a Body Corporate whose shares are listed or admitted to trading on any exchange of an IOSCO member country;

- a trustee of a trust which has, or had during the previous 12 months, assets of at least USD 10 million; or

- any other institutional investor whose main activity is to invest in financial instruments, including an entity dedicated to the securitisation of assets or other financial transactions.

A Large Undertaking is a legal entity which, as at the date of its most recent financial statements, has met at least two of the following requirements:

- the Client has assets of at least USD 20 million on its balance sheet;

- the Client has an annual turnover of at least 40 million US dollars; or

- it has equity of at least USD 2 million.

Assessed Professional client is according to clause 2.5. of the COB Rules individual or legal entity who fulfil the requirements below.

Assessed Professional Clients (individuals) include:

- Clients who have net assets of at least USD 100,000; and

- either:

- The Company assesses the Client, on reasonable grounds, as having sufficient experience and understanding of the relevant Financial Services and any associated risks; or

- The Client has worked or has worked within the last two years for a Company that is licensed with the AIFC or any other financial institution, including a bank, securities firm or insurance company, in a position that requires knowledge of the type of Financial Services or Transactions.

In order to classify a client as an assessed professional client (individuals), the client must certify in writing to the Company that they wish to be recognised as a Professional Client, either:

- in respect of a specific financial product, financial service or transaction; or

- in general.

In such cases, the Company must give the client a clear written warning setting out the protections that the client may lose as a result of not being classified as a retail client and the client must confirm in writing, in a separate document, that it understands the consequences of losing such protections.

Assessed Professional Clients (legal entities) include:

- The Company has assessed a legal entity (which may include assessing the individual or individuals authorised to make investment decisions on behalf of the legal entity) on reasonable grounds that the legal entity (or its employees) has sufficient experience and understanding of the relevant financial services or transactions and any associated risks; and

- the entity has at least USD 1 million of its own funds.

The Company may classify a client as a Professional if it is either a Deemed Professional Client or an Assessed Professional Client.

The difference between a Deemed Professional Client and an Assessed Professional Client is that a Deemed Professional Client is a ‘default client’, simply by holding a professional licence or other supporting documentation.

In the case of Assessed Professional Clients it is necessary to “prove” by documentation that they have experience and expertise in the financial sector, indicate the availability of funds, including bank statements or other assets, and only then can the Company classify the client as a Assessed Professional Client.

1.3. Market Counterparty

A Market Counterparty is a Professional Client, but who does not receive services from the Company, but only execute orders and orders for execution to the Company.

- CLIENT NOTIFICATIONS

The Company is obliged to notify the client of its classification before it starts providing services, in any way that allows the Company to record such notification. In addition, the Company has the right not to provide services to retail clients, but is obliged to notify all clients.

The Company is obliged to grant the right to change classifications to clients. Thus, a Professional client may request in writing to be classified as a retail client, just as a retail client may request to be classified as a professional client (the process is described earlier in this article). However, based on the documents provided, it is up to the Company to classify the client and to take sole responsibility for doing so.

CONCLUSION

Client classification is one of the most important stages of licensing. In the provision of various financial services, the AIFC regulations impose certain restrictions and levels of protection for retail and professional clients. Such restrictions may include protection against negative balances for retail clients, limits on the amount a client can invest or trade on the platform and other restrictions to ensure client protection. Each type of business and client requirements are different and must be considered on a case by case basis.

For more information, we will be happy to advise you:

DISCLAMER

The information in this article does not constitute legal opinion or legal advice. No part of this article may be used as a substitute for obtaining legal opinion or legal advice. This article is for guidance only. Each issue requires individual attention and study. Also, the relevance of this article is subject to change due to changes in the law.

REFERENCES:

- AIFC CONDUCT OF BUSINESS RULES AIFC RULES NO. FR0005 OF 2017 (with amendments as of 12 December 2021, which commence on 01 January 2022).

Whatsapp

Whatsapp

2073

2073

Comments 0

Login to leave a comment