Yet three decades after emerging from the ruins of the USSR, some countries in the region are eager to assert themselves on the global tech map — and the transformations they are now witnessing could put them on the right track.

Numbers to know in Central Asia

| Capital | Surface area | Population (2022) |

GDP (2022) |

Internet penetration (2022) | |

| Kazakhstan | Astana | 2.72 million sq. m. | 19.2 million | $220 billion | 90% |

| Kyrgyzstan | Bishkek | 199,900 sq. m. | 6.8 million | $10.9 billion | 78% |

| Tajikistan | Dushanbe | 143,099 sq. m. | 10 million | $10.5 billion | 40% |

| Turkmenistan | Ashgabat | 488,099 sq. m. | 5.8 million | $40 billion (2018) | 38% |

| Uzbekistan | Tashkent | 448,924 sq. m. | 35.6 million | $80.4 billion | 78% |

At first glance, technology does not account for much in the area. While raw materials generate a large part of each country’s revenue (oil and gas in Kazakhstan and Turkmenistan, gold in Kyrgyzstan), the local tech industries are still embryonic. This year, IT service export volume will be in the hundreds of millions of U.S. dollars. There are no more than 5,000 pre-seed tech startups (including projects without a legal entity) in the whole region, according to an International Finance Corporation (IFC) estimate in 2022, while venture investment there could reach just around $100 million this year.

For the past couple of years, however, these indicators have been growing fast, while the first generation of internationally viable startups has been emerging. These trends are fueled by fast digitalization, large-scale IT education programs, and progress in infrastructure and capital supply.

Since Russia’s invasion of Ukraine in early 2022, the sudden arrival of Russian professionals in Central Asia has boosted the local tech industry. By evading the draft and potentially saving their lives, tens of thousands of programmers have established themselves In Central Asia, bringing highly sought-after skills and experience to local companies and sometimes creating their own.

Kazakhstan: Digital takeoff in the steppe

Beware banknotes in this country: taxi drivers are reluctant to accept them, and unlikely to make change. With the ubiquitous Kaspi mobile app, as well as bank cards, digital payments are more widespread in Kazakhstan’s largest cities than in many Western ones. Seventy-eight percent of the population aged 15 and up made or received digital payments in 2021, up from 54% in 2017. The volume of digital payments in the country grew from $5 billion in 2017 to $158 billion in 2022 (according to RISE Research and National Bank of Kazakhstan, respectively).

Astana (the country’s capital, built recently in the middle of the Kazakh Steppe) and Almaty (Central Asia’s second-largest city with more than 2 million inhabitants) are crowded with fast-delivery couriers and electric scooter drivers. And while everyone can enjoy cheap 4G tariff phone plans, car parks use advanced technologies that offer drivers a touchless entrance, exit and billing experience.

The most advanced country in the region in terms of digitalization, Kazakhstan is also ahead in terms of startup and venture activity. The first initiatives date back 20 years ago with the launch of the National Innovation Fund in 2003 and the adoption of a law on investment and venture funds in 2004. However, tech innovation programs truly kicked off in 2018, when the government launched Astana Hub and Astana International Financial Centre.

The latter provides an international legal framework to facilitate company creation and investment activity. The former is the largest technology center in the region, supporting students, entrepreneurs and companies through a variety of programs. As of late 2022, Astana Hub boasted 1,007 resident companies — including 216 abroad — which reportedly generated $504 million in revenue during the year (up 300% from 2020) and raised $132 million (up 150% from 2020). Astana Hub collaborates with global tech leaders such as Airbus, Apple, Binance, EPAM, the Ethereum Foundation, Google, Meta, Plug and Play, Tencent and others.

A partnership has been launched with Draper University to “create a bridge between the IT communities of Turkic countries and California.” As a result, Astana Hub’s top 20 startups were expected to fly to Silicon Valley in May of this year.

The young ecosystem also features private initiatives such as the incubation programs of Jas Ventures in Almaty (in partnership with StartX at Stanford University) and Terricon Valley in Karaganda. This industrial city in the north of the country is becoming a tech hub with a variety of universities, training, incubators and acceleration programs.

Since last year, the arrival of cohorts of Russians and Belarusians in Kazakhstan has brought a strong impetus to the local tech scene. Not only have local companies been able to hire highly qualified programmers, designers, marketers and analysts, but some top-level tech companies have relocated some of their staff and offices to Almaty and Astana. Notable examples include EPAM, inDrive, Playrix, Tinkoff and Yandex.

Investment activity

At the country level, Most Ventures — the leading, privately held VC fund in Central Asia — identified 175 domestic startup investment deals between 2018-2022, totaling about $87 million. Last year alone accounted for 43 deals and $35 million. Many believe, however, that as many as 40% of startup deals happen under the radar; thus, the true market size in 2022 could be as much as $60 million. This does not include the deals made abroad by startups from Kazakhstan.

The average domestic deal remains modest in size, but is growing fast. It was $822,000 in 2022, which is twice as much as the average of the previous years (see the Most report).

The domestic market is maturing, “with a significant number of successful M&As and a growing number of corporate investors,” according to the report.

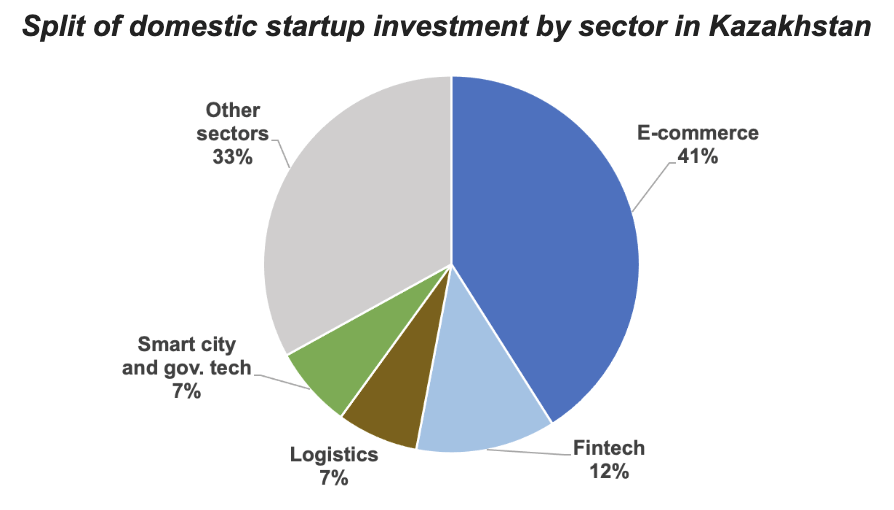

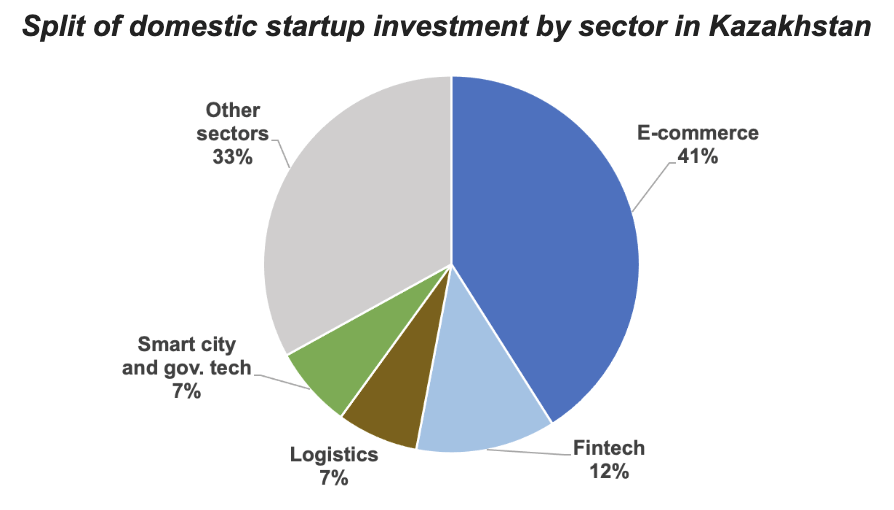

More than half of startup investments in Kazakhstan go to fintech and e-commerce companies. The two local leaders in these fields, Kaspi Bank and Chocolife, have historically received foreign investments.

Baring Vostok — a U.S.-managed fund based in Moscow until recently made an initial $100 million injection into Kaspi in 2007, which put the company on the path to a London IPO in 2020. Dutch business angel Bas Godska has invested $120,000 in total to Chocolife since the company’s pre-seed funding round in 2011.

Lately, the most active foreign investor in Kazakhstan has been Singapore’s Tesla Capital, which has stakes in four local startups.

Local startup investors

According to Most, between 2018 and 2022, 45% of the total local funding was made by individual investors; 16% was from incubators and accelerators; and only 8% was by funds. There are around 15 active angel investors operating publicly — including Murat Abdrakhmanov, Erik Aubakirov (EA Group) and Bakht Niyazov (Falconry) — in addition to some 200 investors working “behind the scenes.”

“In Central Asia, the institutional investment landscape is less developed than in advanced startup ecosystems. This is due to limited venture capital firms, underdeveloped capital markets, regulatory challenges and other factors,” explains Niyazov.

“Individual investors often step in to fill this gap, providing the necessary funding and expertise to early-stage startups. Many individual investors in Central Asia are successful entrepreneurs themselves. They have first-hand experience building businesses and can provide valuable insights, mentorship and operational support to startups,” added Niyazov, who made his fortune in the 2000s as a broker on the Kazakhstan stock exchange.

“In Central Asia, the institutional investment landscape is less developed than in advanced startup ecosystems. This is due to limited venture capital firms, underdeveloped capital markets, regulatory challenges and other factors.”

–Bakht Niyazov, Co-founder of Most Holding

The country’s largest privately backed VC funds include Most Ventures (16 portfolio companies) and Activat.vc (13 portfolio companies). Government-funded, but privately managed, VCs include Tech Gardens Ventures (41 portfolio companies) and Tumar VC, which launched in early 2023 with $50 million (one portfolio company).

Considering the small number of mature, investable local startups, some Kazakhstani investors are eyeing the global market. Thus, last year, Adil Nurgozhin — a prominent figure of the Kazakhstan investment scene — established his new fund, Big Sky Capital, in Singapore. Its portfolio does include two Kazakhstani startups, however.

Since its inception in June 2022, MyVentures has already invested in six foreign startups originating from the U.S., the UAE and Taiwan — while its portfolio contains only three Kazakhstani startups. These international deals came as the result of an investor accreditation with 500 Global.

“Without this intermediation, access to international deals would be extremely limited due to our kind of exotic origin,” said MyVentures CEO Shakhboz Rakhmanov.

Globally oriented startups in Kazakhstan

Kazakhstan’s top startups with international traction include the following:

- Cerebra, whose AI-powered software makes possible “early stroke detection for faster and more accurate treatment.” Founded in 2018, this startup has raised $1.3 million in total thus far from local investors and Singapore’s Quest Ventures.

- CitiX, the local leader in digital outdoor advertising and city information, was established in 2016. The company claims nearly $1 million in monthly recurring revenue as of May 2023 and values itself at $100 million. In 2021, it raised $3 million from Timur Turlov, the founder of local brokerage company Freedom Holding. In 2022, it signed its first contracts with foreign customers (in Turkey and the UAE) and it has plans to expand to Saudi Arabia and the U.S.

- Clockster, founded in 2015, develops solutions for frontline staff management and business automation. Having raised $2.1 million in total from local and international investors (including 500 Global, Singapore’s Quest Ventures and BigSky Capital, Most Ventures and local angels), it recently moved its HQ to Jakarta, Indonesia.

- Jet, an e-scooter rental service launched in 2021, has raised $3 million from local investors. It currently serves 14 cities in six countries in Central Asia and Eastern Europe.

- Parqour, a smart parking technology provider founded in 2020. The company expects to generate several millions of U.S. dollars in recurring revenue this year — a rare performance in the region. EA Ventures, a major Kazakhstani private equity/VC investor, has committed $5 million to Parqour to support its expansion across the U.S., Europe and Asia.

- S1lkPay, a financial services company that specializes in mobile banking, card payments, money remittance and foreign exchange. Having raised $7.3 million in 2021 and 2022, this startup recently moved its headquarters to Dubai and is launching in Sudan.

Uzbekistan: High-speed industry development

Virtually nonexistent a few years ago, the Uzbek tech sector is developing quickly and contributing to an “unprecedented economic and social transformation,” as noted by the World Bank.

While IT service exports amounted to a negligible $600,000 in 2017, the country’s sales now reach the same number daily, according to IT Park. About 80% of these exports go to the U.S.

Over the past couple of years, the first supporting institutions have been built. Launched in 2019 as a government initiative, IT Park has already established 205 IT centers across Uzbekistan as well as several dozens of incubators within universities. As of May 2023, IT Park boasts more than 1,200 resident companies, including 185 with foreign capital participation.

Residents enjoy special tax benefits, offices and working spaces, IT and BPO education programs, legal assistance, and a variety of startup support programs. IT Park also worked with Plug and Play to launch an international acceleration program in March 2023.

Many other initiatives have been launched — from the “One Million Uzbek Coders” program to a presidential startup competition with a $1 million prize.

There’s still a lot to do, however, on the government side to adapt local legislation and better coordinate the bodies involved in the startup ecosystem development.

The local startup scene is vibrant, but still very tiny. In 2022, the IFC identified around 1,000 pre-seed startups or projects (with or without a legal entity) in the country, while investment volumes amounted to about $20 million. Only 50 startups received VC funding in the past four years.

All this explains why so few funds are currently active — to various extents — on the local scene.

- Aloqa Ventures, which is affiliated with a major local bank, started investing in June 2022. Less than a year later, it has a stake in 12 startups from Uzbekistan and neighboring Central Asian countries (including Tajik Zypl.ai). It now considers investing outside the region (e.g. in Georgia) with plans to invest $2 million per year.

- Semurg VC, backed by local high-net-worth individual Ulugbek Mirzamukhamedov and a major local insurance company, launched in 2021. This $5 million fund has already spent $1.5 million on local fintech projects and is prepared to help them expand internationally.

- UzCard Ventures, the venture arm of local electronic payment leader Uzcard.

- The state-backed fund-of-funds UzVC, which also invests in startups directly.

A handful of international funds have also made some investments in Uzbek startups. These include Sturgeon Capital and Battery Road Digital Holdings along with a few less active firms.

At the ideation, or pre-seed, stage Uzbek startup entrepreneurs may also apply for $5,000 grants from UNDP. Several wealthy individuals are starting to eye the emerging startup field. Their terms, however, are not always aligned with entrepreneurs’ interests and professional venture standards. But local players feel confident about future industry developments.

“Uzbekistan is rather advanced in terms of digitalization,” said Semurg VC investment director Alisher Bozorov. “We see positive trends, such as the emergence of agritech startups and strong AI projects.”

The culture of startup entrepreneurship and investment is growing quickly.

“The local scene is not mature yet, but there is now a momentum with people starting to understand the possibility of launching an IT business or a startup,” said Artem Panferov, a Russian IT professional who relocated to Uzbekistan a year ago.

“The local scene is not mature yet, but there is now a momentum with people starting to understand the possibility of launching an IT business or a startup.”

-Artem Panferov, Russian IT professional

Here are examples of startups born in Uzbekistan:

- Retail tech solution provider Billz, which has been backed by Sturgeon Capital and Quest Ventures;

- Low-code mobile app developer EndCode, founded by Panferov;

- Iman Invest, “a full-stack halal finance solution for merchants, shoppers and investors,” which received $1 million from a variety of local and foreign investors in its seed round in 2022;

- Mobile tipping app Rahmat, which has plans to expand to neighboring markets; and

- Tass Vision, born in Uzbekistan, provides offline retailers with “next-gen AI solutions” to analyze customers’ and employees’ behavior. It claims to serve customers in more than 700 locations. Registered in Delaware, it has raised $370,000 so far — including $100,000 from 500 Global — and is now aiming to raise $1 million.

Kyrgyzstan: From IT outsourcing to tech startups

Kyrgyzstan — whose recent history has been turbulent, but relatively democratic — was the first country in the region to develop an IT sector.

“Since we have no access to oceans, the internet became our ocean,” said Azis Abakirov, a figure of the local IT scene who founded an outsourcing company 20 years ago.

This small country is home to hundreds of such companies and numerous freelancers. Enjoying tax preferences, Kyrgyz IT service exporters sell mainly to the U.S., Germany, Japan, Korea and the UAE.

Founded in 2011, the local IT Park has more than 200 residents and employs about 2,000 people. These companies exported $50 million worth of services in 2022 and expect to double their performance in 2023.

Kyrgyz startups usually emerge from the IT Park. The entrepreneurs are globally-minded and report that Silicon Valley, Singapore and Japan are among their desired destinations.

Kyrgyzstan’s notable startups include:

- FitJab.io, which develops a “Muslim-friendly fitness application for women”;

- GoDee, an app to book public transportation services. It first launched in Ho Chi Minh City, Vietnam;

- Growave, an all-in-one marketing platform for small and medium-sized Shopify brands, which reports more than 13,000 customers across the world;

- Kodif.io, a low-code platform for scalable CX automations with Kyrgyz founders. It recently secured $3.1 million in a seed round led by Bling Capital, a major international VC fund based in Miami; and

- NB Fit, an award-winning women’s online training app that is going global.

Created by a team from Kyrgyzstan in 2019, D Billions boasts nearly 31 billion views on YouTube alone for its kids’ entertainment content as of May 2023. Its most popular song, “Clap-Clap Cha-Cha-Cha,” has generated 2.5 billion views on YouTube. Another recent video, “My Name Is,” has inspired countless user-generated videos worldwide, including 2.1 million on TikTok as of May 2023.

Very few tech investors operate locally. Among them are angel investors, the Kazakhstani fund Most Ventures and Aga Khan’s Accelerate Prosperity. Recently, this nonprofit announced an acceleration program with $50,000 equity injections, in partnership with the United States Agency for International Development.

Some foreign tech companies have settled in Kyrgyzstan, including Alawar, EPAM, HH.ru and Hypha. Founded in 2020 by U.K. businessman Louis French, Hypha has hired a Kyrgyz team to develop a graph-based cloud app “for collective team intelligence.”

Tajikistan: First steps toward tech innovation

Tajikistan is behind most of its Central Asia neighbors in terms of digitalization, IT outsourcing and a startup ecosystem. The country is taking steps in the right direction, however.

Since 2018, the State Business Incubator — which is now established in five cities within the country — offers an array of support services to entrepreneurs, including those working in tech. Local startups may also get support from international organizations such as the UNDP, Germany’s GIZ, the Japan International Cooperation Agency, USAID and Accelerate Prosperity.

A state-backed technology park is under construction in Dushanbe, the capital city. Designed with support from the UNDP, its purpose is to develop Tajikistan’s IT capacities, accelerate startups and attract international tech companies to the country.

A few private investors operate in Tajikistan. One of them is FiftyFive Group, a multifaceted investment and management company that is behind the country’s main online travel agency, Fly.tj, and aims to develop new ventures.

There are only a few angel investors in the country — who generally have limited experience and no venture funds yet. The local legislation has yet to be adapted for such activity to emerge.

Top Tajik startups include:

- DocMed, an online medical appointment platform that operates domestically;

- FiftyFive Group‘s FlySoft, which has begun selling its air ticket booking solutions across the region; and

- Zypl.ai, which has developed “a SaaS fintech startup deploying machine learning to advance microfinance.”

Zypl.ai is the startup pride of the nation. Founded in 2021 by Azizjon Azimi, a Tajik entrepreneur who has degrees from Stanford and Harvard, this startup has attracted funding from foreign investors. These include Aloqa Ventures (Uzbekistan), Battery Road Digital Holdings (India) and Presto Ventures (Czech Republic) through a $1.1 million pre-seed round in September 2022; as well as TumarVC (Kazakhstan), which provided funding in early 2023.

Tajikistan is also home to a fintech and e-commerce company called Alif. Founded in 2014, it has expanded to Uzbekistan and the UAE, and is now eyeing new markets in the Middle East and Asia. In September 2021, Alif completed a Series A round, raising $8 million in equity and $50 million in debt at a valuation exceeding $100 million.

Turkmenistan: A handful of pioneers

The least open country in the region, Turkmenistan is also the least developed in terms of tech innovation.

A few initiatives have emerged over the past few years, however. Launched in 2020 with support from USAID, along with the local Academy of Sciences, Startup Academy has incubated around 70 young companies, which include a growing number of tech startups.

Startup Academy has also launched a business angel club. No deals have been made so far, but Turkmen aspiring investors can enjoy a series of EBRD-backed seminars.

While local legislation has yet to be adapted for startup and venture activity, no state support program has been launched so far. However, the government is considering taking steps in that direction, with discussions currently revolving around a potential “agency for innovation development.”

Notable startups in Turkmenistan include:

A handful of Turkmen founders operate startups abroad. These include the Freezone app, which started in Russia but reportedly has plans to move to another jurisdiction; and KinesteX, which has its headquarters in Dubai and a team in Turkmenistan.

“Startup culture is virtually nonexistent in Turkmenistan,” said a local businessman. “The very notion of a startup is too recent and little-known, and neither the legislation nor the infrastructure is ready.”

Local IT outsourcing is embryonic, too — but IT education has been developing fast recently. Many universities host IT faculties, while domestic and foreign IT courses are growingly available.

Central Asian startups on the global stage

While many Central Asian startups operate domestically — from e-commerce, to delivery, to financial, to medical — others are geared toward foreign markets.

“A startup that stays in the country is unlikely to make a 1,000x return,” said Asror Arabjanov, a Stanford law grad corporate lawyer from Uzbekistan.

Many of these globally minded startups target the U.S. market — which is also the case for a number of their peers from Russia, Ukraine, Belarus and other former Soviet Union countries. A significant number target the Middle East and Asia, which they feel are more accessible geographically and perhaps culturally. Europe is a rarer destination. Russia, which used to be a natural first step for many Central Asian startups, has lost much of its appeal because of its war with Ukraine and the subsequent international sanctions.

Several international acceleration programs were launched recently to support startups in Central Asia. These include the EBRD’s Star Venture (Kazakhstan, with planned extension to other countries of the region), Plug and Play (Kazakhstan, Uzbekistan) and Google for Startups (Kazakhstan).

10 internationally oriented startups born in Central Asia

| Startup | Origin | Solution | Investments | International |

| CitiX | Kazakhstan | Digital outdoor advertising and city information | $3 million from a local investor | First foreign sales in Turkey, expansion plans for the UAE, Saudi Arabia and U.S. |

| Clockster | Kazakhstan | Staff management and business automation | $1.5 million from local and international investors | HQ and traction in Indonesia |

| D Billions | Kyrgyzstan | Kids’ entertainment video content | N/A | Global traction (31 billion views on YouTube) |

| Growave | Kyrgyzstan | Marketing platform for small and medium-sized Shopify brands | N/A | Reports 13,000 customers across the world |

| Iman Invest | Uzbekistan | Halal finance solution | $1 million from local and international investors | Aims to attract 1 billion users worldwide |

| Jet | Kazakhstan | E-scooter rental service | $3 million from local investors | Active in six countries in Central Asia and Eastern Europe |

| Kodif.io | Kyrgyzstan | Low-code platform for scalable CX automations | $3.1 million from international investors | HQ in California |

| Parqour | Kazakhstan | Smart parking | $5 million injected or committed from a local investor | Sales in the U.S., Middle East, Southeast Asia, Europe; in the process of moving HQ to the U.S. |

| S1lkPay | Kazakhstan | Financial services company that specializes in mobile banking | $7.3 million from undisclosed investors | HQ in Dubai, first projects in Middle East and Africa |

| Zypl.ai | Tajikistan | SaaS fintech startup deploying machine learning | $1.1 million from Central Asian and international investors | Active in several countries within Central Asia and the Middle East |

Some Central Asian entrepreneurs have founded or co-founded their companies abroad — sometimes without any ties to their country of origin. Examples of successful projects include:

- U.K.-based Behavox, which has raised more than $120 million to develop its AI-driven platform for corporate data analysis;

- U.S. HR tech startup Celential, which secured $9.5 million;

- U.K. fintech DNA Payments, which has raised 100 million pounds ($124.35 million) and acquired several companies; and

- U.S.-based Honorlock, which provides proctoring services for colleges and universities, and raised $40.7 million.

(More of these success stories can be read here.)

Some of these founders find support from local diasporas. For example, “Many entrepreneurs from Central Asia — as well as other parts of the former Soviet Union — operate in the U.S. transportation industry, especially long-haul commercial trucking. Uzbeks own fleets in all categories, from a few trucks to hundreds or thousands,” said Arabjanov.

“These Uzbek-founded U.S. trucking companies outsource their work to BPO companies in Uzbekistan,” he said. “They even generate demand for IT products, especially transport management systems and workforce automation — stimulating startup activity in this field.”

Arabjanov is the founder of datatruck, a U.S. company that develops a workforce automation platform for trucking companies.

International VCs in Central Asia

International investors are much less active in Central Asia than in other emerging areas such as Africa, India or Latin America. The reasons include the small number of internationally viable startups, the lack of infrastructure and adapted legal framework — particularly in Tajikistan and Turkmenistan — and, simply, the lack of information and awareness about a region that usually slips under the radar.

Here are notable international firms investing in Central Asia:

- Baring Vostok, a major U.S.-managed private equity/VC fund that was based in Moscow until recently. As seen above, this fund backed Kazakhstan’s Kaspi Bank in its early days — about 13 years before its London IPO. Baring Vostok also invested in classifieds platforms Kolesa.kz ($15 million in 2014), Krysha.kz and Market.kz.

- Battery Road Digital Holdings, headquartered in Mumbai, India. While owning a stake in Zypl.ai (Tajikistan) and Iman Invest (Uzbekistan), this fund might not continue backing Central Asian startups due to its new focus on private equity investments, an industry insider said.

- Big Sky Capital, established in Singapore by Kazakhstani VC Adil Nurgozhin, this firm is still investing in Kazakhstan (Clockster, Kwaaka).

- Quest Ventures, another Singapore-based fund, has stakes in Billz.io (Uzbekistan), Cerebra, Clockster and 1Fit (Kazakhstan).

- Sturgeon Capital, a U.K.-based $275 million private equity/VC fund targeting “frontier markets” — including Central Asia, Egypt, Bangladesh and Pakistan — where they see a “$300 billion opportunity.” This fund has made a few investments in Uzbekistan since 2019, focusing on e-commerce and fintech projects with an international dimension. They are now raising a new fund with a $50 million target to invest specifically in Uzbekistan and other Central Asian countries.

- Tesla Capital, an impact fund from Singapore with stakes in Clockster, CTOgram, Smart Satu, Toidriver, Uvu (Kazakhstan) and Iman (Uzbekistan).

- TUZ Ventures, backed by a Mongolian businessman who wants to “unlock Central Asia” and the Caucasus. However, the company’s activity has been less noticeable in the past years.

- 500 Global has supported several startups from the region (e.g. Clockster, Iman, One App and TASS Vision).

Some other foreign funds have been involved occasionally (e.g. Singapore-based funds Le Mercier and MyAsia VC backing Iman Invest; Dutch business angel Bas Godska investing in Chocolife).

What to expect next

Even though startup and venture activity is still very modest in these countries, Kazakhstan, Uzbekistan and Kyrgyzstan (despite the latter’s modest size) could emerge tomorrow as new hot spots on the global scene.

“This is a frontier market in the sense that a lot of things are not fully developed and digitized yet. Hence there are a lot of opportunities to build truly vertically integrated projects,” said Bakhtiyar Kubessov, CBDO at Citix. “Couple this with a pretty high level of education in several countries of the region, and you could get a hub for technological companies.”

“This is a frontier market in the sense that a lot of things are not fully developed and digitized yet. Hence there are a lot of opportunities to build truly vertically integrated projects. Couple this with a pretty high level of education in several countries of the region, and you could get a hub for technological companies.”

-Bakhtiyar Kubessov, CBDO at Citix

Pavel Koktyshev, managing partner at Most, believes that “Central Asia has a high potential to attract international venture investors.” He highlights specific niches such as technology and digitalization, agriculture and agritech, eco-tourism and renewable energy for rural areas as industries with a lot of potential.

Development finance institutions have already stepped in. ADB Ventures, the EU, GIZ, USAID, UNDP, World Bank and others are involved in a variety of programs that aim to support sustainable economic growth through technology development. After studying the region’s potential thoroughly, World Bank affiliate IFC is open to backing new, locally-focused venture funds.

While a pioneer like Sturgeon Capital is raising new funds, several international VCs are eyeing the region. Recent examples include a leading Western fund manager, who sees an “exceptional investment opportunity” in the “fast-emerging Eurasian tech ecosystem.”

While addressing “a fundamental market dislocation in the region — insufficient venture funding and mentorship from experienced VCs in growing high velocity, scalable companies,” the considered new fund would “build a bridge” to the most advanced markets.

Investing in Central Asia might indeed be a good bet, provided that the region remains resilient to the geopolitical turbulence that surrounds it.

*In addition to the people quoted above, Alim Hamitov (Most Ventures), Amirkhan Omarov (Parqour), and Bekzod Sobirov (Uzbekistan expert), as well as Accelerate Prosperity, Astana Hub, digitalbusiness.kz, EBRD, IFC and IT Park Uzbekistan provided information for this overview.

Adrien Henni has more than a decade of venture and startup experience in Eastern Europe and Central Asia. He is the founder of International Digital News, a tech news and market research agency covering these regions, and is an adviser to a variety of startups and investors. These include DocMed, FiftyFive Group and Parqour, which are cited in this article and located in Central Asia.

https://about.crunchbase.com/topics/crunchbase-partnerships/

Yet three decades after emerging from the ruins of the USSR, some countries in the region are eager to assert themselves on the global tech map — and the transformations they are now witnessing could put them on the right track.

Numbers to know in Central Asia

| Capital | Surface area | Population (2022) |

GDP (2022) |

Internet penetration (2022) | |

| Kazakhstan | Astana | 2.72 million sq. m. | 19.2 million | $220 billion | 90% |

| Kyrgyzstan | Bishkek | 199,900 sq. m. | 6.8 million | $10.9 billion | 78% |

| Tajikistan | Dushanbe | 143,099 sq. m. | 10 million | $10.5 billion | 40% |

| Turkmenistan | Ashgabat | 488,099 sq. m. | 5.8 million | $40 billion (2018) | 38% |

| Uzbekistan | Tashkent | 448,924 sq. m. | 35.6 million | $80.4 billion | 78% |

At first glance, technology does not account for much in the area. While raw materials generate a large part of each country’s revenue (oil and gas in Kazakhstan and Turkmenistan, gold in Kyrgyzstan), the local tech industries are still embryonic. This year, IT service export volume will be in the hundreds of millions of U.S. dollars. There are no more than 5,000 pre-seed tech startups (including projects without a legal entity) in the whole region, according to an International Finance Corporation (IFC) estimate in 2022, while venture investment there could reach just around $100 million this year.

For the past couple of years, however, these indicators have been growing fast, while the first generation of internationally viable startups has been emerging. These trends are fueled by fast digitalization, large-scale IT education programs, and progress in infrastructure and capital supply.

Since Russia’s invasion of Ukraine in early 2022, the sudden arrival of Russian professionals in Central Asia has boosted the local tech industry. By evading the draft and potentially saving their lives, tens of thousands of programmers have established themselves In Central Asia, bringing highly sought-after skills and experience to local companies and sometimes creating their own.

Kazakhstan: Digital takeoff in the steppe

Beware banknotes in this country: taxi drivers are reluctant to accept them, and unlikely to make change. With the ubiquitous Kaspi mobile app, as well as bank cards, digital payments are more widespread in Kazakhstan’s largest cities than in many Western ones. Seventy-eight percent of the population aged 15 and up made or received digital payments in 2021, up from 54% in 2017. The volume of digital payments in the country grew from $5 billion in 2017 to $158 billion in 2022 (according to RISE Research and National Bank of Kazakhstan, respectively).

Astana (the country’s capital, built recently in the middle of the Kazakh Steppe) and Almaty (Central Asia’s second-largest city with more than 2 million inhabitants) are crowded with fast-delivery couriers and electric scooter drivers. And while everyone can enjoy cheap 4G tariff phone plans, car parks use advanced technologies that offer drivers a touchless entrance, exit and billing experience.

The most advanced country in the region in terms of digitalization, Kazakhstan is also ahead in terms of startup and venture activity. The first initiatives date back 20 years ago with the launch of the National Innovation Fund in 2003 and the adoption of a law on investment and venture funds in 2004. However, tech innovation programs truly kicked off in 2018, when the government launched Astana Hub and Astana International Financial Centre.

The latter provides an international legal framework to facilitate company creation and investment activity. The former is the largest technology center in the region, supporting students, entrepreneurs and companies through a variety of programs. As of late 2022, Astana Hub boasted 1,007 resident companies — including 216 abroad — which reportedly generated $504 million in revenue during the year (up 300% from 2020) and raised $132 million (up 150% from 2020). Astana Hub collaborates with global tech leaders such as Airbus, Apple, Binance, EPAM, the Ethereum Foundation, Google, Meta, Plug and Play, Tencent and others.

A partnership has been launched with Draper University to “create a bridge between the IT communities of Turkic countries and California.” As a result, Astana Hub’s top 20 startups were expected to fly to Silicon Valley in May of this year.

The young ecosystem also features private initiatives such as the incubation programs of Jas Ventures in Almaty (in partnership with StartX at Stanford University) and Terricon Valley in Karaganda. This industrial city in the north of the country is becoming a tech hub with a variety of universities, training, incubators and acceleration programs.

Since last year, the arrival of cohorts of Russians and Belarusians in Kazakhstan has brought a strong impetus to the local tech scene. Not only have local companies been able to hire highly qualified programmers, designers, marketers and analysts, but some top-level tech companies have relocated some of their staff and offices to Almaty and Astana. Notable examples include EPAM, inDrive, Playrix, Tinkoff and Yandex.

Investment activity

At the country level, Most Ventures — the leading, privately held VC fund in Central Asia — identified 175 domestic startup investment deals between 2018-2022, totaling about $87 million. Last year alone accounted for 43 deals and $35 million. Many believe, however, that as many as 40% of startup deals happen under the radar; thus, the true market size in 2022 could be as much as $60 million. This does not include the deals made abroad by startups from Kazakhstan.

The average domestic deal remains modest in size, but is growing fast. It was $822,000 in 2022, which is twice as much as the average of the previous years (see the Most report).

The domestic market is maturing, “with a significant number of successful M&As and a growing number of corporate investors,” according to the report.

More than half of startup investments in Kazakhstan go to fintech and e-commerce companies. The two local leaders in these fields, Kaspi Bank and Chocolife, have historically received foreign investments.

Baring Vostok — a U.S.-managed fund based in Moscow until recently made an initial $100 million injection into Kaspi in 2007, which put the company on the path to a London IPO in 2020. Dutch business angel Bas Godska has invested $120,000 in total to Chocolife since the company’s pre-seed funding round in 2011.

Lately, the most active foreign investor in Kazakhstan has been Singapore’s Tesla Capital, which has stakes in four local startups.

Local startup investors

According to Most, between 2018 and 2022, 45% of the total local funding was made by individual investors; 16% was from incubators and accelerators; and only 8% was by funds. There are around 15 active angel investors operating publicly — including Murat Abdrakhmanov, Erik Aubakirov (EA Group) and Bakht Niyazov (Falconry) — in addition to some 200 investors working “behind the scenes.”

“In Central Asia, the institutional investment landscape is less developed than in advanced startup ecosystems. This is due to limited venture capital firms, underdeveloped capital markets, regulatory challenges and other factors,” explains Niyazov.

“Individual investors often step in to fill this gap, providing the necessary funding and expertise to early-stage startups. Many individual investors in Central Asia are successful entrepreneurs themselves. They have first-hand experience building businesses and can provide valuable insights, mentorship and operational support to startups,” added Niyazov, who made his fortune in the 2000s as a broker on the Kazakhstan stock exchange.

“In Central Asia, the institutional investment landscape is less developed than in advanced startup ecosystems. This is due to limited venture capital firms, underdeveloped capital markets, regulatory challenges and other factors.”

–Bakht Niyazov, Co-founder of Most Holding

The country’s largest privately backed VC funds include Most Ventures (16 portfolio companies) and Activat.vc (13 portfolio companies). Government-funded, but privately managed, VCs include Tech Gardens Ventures (41 portfolio companies) and Tumar VC, which launched in early 2023 with $50 million (one portfolio company).

Considering the small number of mature, investable local startups, some Kazakhstani investors are eyeing the global market. Thus, last year, Adil Nurgozhin — a prominent figure of the Kazakhstan investment scene — established his new fund, Big Sky Capital, in Singapore. Its portfolio does include two Kazakhstani startups, however.

Since its inception in June 2022, MyVentures has already invested in six foreign startups originating from the U.S., the UAE and Taiwan — while its portfolio contains only three Kazakhstani startups. These international deals came as the result of an investor accreditation with 500 Global.

“Without this intermediation, access to international deals would be extremely limited due to our kind of exotic origin,” said MyVentures CEO Shakhboz Rakhmanov.

Globally oriented startups in Kazakhstan

Kazakhstan’s top startups with international traction include the following:

- Cerebra, whose AI-powered software makes possible “early stroke detection for faster and more accurate treatment.” Founded in 2018, this startup has raised $1.3 million in total thus far from local investors and Singapore’s Quest Ventures.

- CitiX, the local leader in digital outdoor advertising and city information, was established in 2016. The company claims nearly $1 million in monthly recurring revenue as of May 2023 and values itself at $100 million. In 2021, it raised $3 million from Timur Turlov, the founder of local brokerage company Freedom Holding. In 2022, it signed its first contracts with foreign customers (in Turkey and the UAE) and it has plans to expand to Saudi Arabia and the U.S.

- Clockster, founded in 2015, develops solutions for frontline staff management and business automation. Having raised $2.1 million in total from local and international investors (including 500 Global, Singapore’s Quest Ventures and BigSky Capital, Most Ventures and local angels), it recently moved its HQ to Jakarta, Indonesia.

- Jet, an e-scooter rental service launched in 2021, has raised $3 million from local investors. It currently serves 14 cities in six countries in Central Asia and Eastern Europe.

- Parqour, a smart parking technology provider founded in 2020. The company expects to generate several millions of U.S. dollars in recurring revenue this year — a rare performance in the region. EA Ventures, a major Kazakhstani private equity/VC investor, has committed $5 million to Parqour to support its expansion across the U.S., Europe and Asia.

- S1lkPay, a financial services company that specializes in mobile banking, card payments, money remittance and foreign exchange. Having raised $7.3 million in 2021 and 2022, this startup recently moved its headquarters to Dubai and is launching in Sudan.

Uzbekistan: High-speed industry development

Virtually nonexistent a few years ago, the Uzbek tech sector is developing quickly and contributing to an “unprecedented economic and social transformation,” as noted by the World Bank.

While IT service exports amounted to a negligible $600,000 in 2017, the country’s sales now reach the same number daily, according to IT Park. About 80% of these exports go to the U.S.

Over the past couple of years, the first supporting institutions have been built. Launched in 2019 as a government initiative, IT Park has already established 205 IT centers across Uzbekistan as well as several dozens of incubators within universities. As of May 2023, IT Park boasts more than 1,200 resident companies, including 185 with foreign capital participation.

Residents enjoy special tax benefits, offices and working spaces, IT and BPO education programs, legal assistance, and a variety of startup support programs. IT Park also worked with Plug and Play to launch an international acceleration program in March 2023.

Many other initiatives have been launched — from the “One Million Uzbek Coders” program to a presidential startup competition with a $1 million prize.

There’s still a lot to do, however, on the government side to adapt local legislation and better coordinate the bodies involved in the startup ecosystem development.

The local startup scene is vibrant, but still very tiny. In 2022, the IFC identified around 1,000 pre-seed startups or projects (with or without a legal entity) in the country, while investment volumes amounted to about $20 million. Only 50 startups received VC funding in the past four years.

All this explains why so few funds are currently active — to various extents — on the local scene.

- Aloqa Ventures, which is affiliated with a major local bank, started investing in June 2022. Less than a year later, it has a stake in 12 startups from Uzbekistan and neighboring Central Asian countries (including Tajik Zypl.ai). It now considers investing outside the region (e.g. in Georgia) with plans to invest $2 million per year.

- Semurg VC, backed by local high-net-worth individual Ulugbek Mirzamukhamedov and a major local insurance company, launched in 2021. This $5 million fund has already spent $1.5 million on local fintech projects and is prepared to help them expand internationally.

- UzCard Ventures, the venture arm of local electronic payment leader Uzcard.

- The state-backed fund-of-funds UzVC, which also invests in startups directly.

A handful of international funds have also made some investments in Uzbek startups. These include Sturgeon Capital and Battery Road Digital Holdings along with a few less active firms.

At the ideation, or pre-seed, stage Uzbek startup entrepreneurs may also apply for $5,000 grants from UNDP. Several wealthy individuals are starting to eye the emerging startup field. Their terms, however, are not always aligned with entrepreneurs’ interests and professional venture standards. But local players feel confident about future industry developments.

“Uzbekistan is rather advanced in terms of digitalization,” said Semurg VC investment director Alisher Bozorov. “We see positive trends, such as the emergence of agritech startups and strong AI projects.”

The culture of startup entrepreneurship and investment is growing quickly.

“The local scene is not mature yet, but there is now a momentum with people starting to understand the possibility of launching an IT business or a startup,” said Artem Panferov, a Russian IT professional who relocated to Uzbekistan a year ago.

“The local scene is not mature yet, but there is now a momentum with people starting to understand the possibility of launching an IT business or a startup.”

-Artem Panferov, Russian IT professional

Here are examples of startups born in Uzbekistan:

- Retail tech solution provider Billz, which has been backed by Sturgeon Capital and Quest Ventures;

- Low-code mobile app developer EndCode, founded by Panferov;

- Iman Invest, “a full-stack halal finance solution for merchants, shoppers and investors,” which received $1 million from a variety of local and foreign investors in its seed round in 2022;

- Mobile tipping app Rahmat, which has plans to expand to neighboring markets; and

- Tass Vision, born in Uzbekistan, provides offline retailers with “next-gen AI solutions” to analyze customers’ and employees’ behavior. It claims to serve customers in more than 700 locations. Registered in Delaware, it has raised $370,000 so far — including $100,000 from 500 Global — and is now aiming to raise $1 million.

Kyrgyzstan: From IT outsourcing to tech startups

Kyrgyzstan — whose recent history has been turbulent, but relatively democratic — was the first country in the region to develop an IT sector.

“Since we have no access to oceans, the internet became our ocean,” said Azis Abakirov, a figure of the local IT scene who founded an outsourcing company 20 years ago.

This small country is home to hundreds of such companies and numerous freelancers. Enjoying tax preferences, Kyrgyz IT service exporters sell mainly to the U.S., Germany, Japan, Korea and the UAE.

Founded in 2011, the local IT Park has more than 200 residents and employs about 2,000 people. These companies exported $50 million worth of services in 2022 and expect to double their performance in 2023.

Kyrgyz startups usually emerge from the IT Park. The entrepreneurs are globally-minded and report that Silicon Valley, Singapore and Japan are among their desired destinations.

Kyrgyzstan’s notable startups include:

- FitJab.io, which develops a “Muslim-friendly fitness application for women”;

- GoDee, an app to book public transportation services. It first launched in Ho Chi Minh City, Vietnam;

- Growave, an all-in-one marketing platform for small and medium-sized Shopify brands, which reports more than 13,000 customers across the world;

- Kodif.io, a low-code platform for scalable CX automations with Kyrgyz founders. It recently secured $3.1 million in a seed round led by Bling Capital, a major international VC fund based in Miami; and

- NB Fit, an award-winning women’s online training app that is going global.

Created by a team from Kyrgyzstan in 2019, D Billions boasts nearly 31 billion views on YouTube alone for its kids’ entertainment content as of May 2023. Its most popular song, “Clap-Clap Cha-Cha-Cha,” has generated 2.5 billion views on YouTube. Another recent video, “My Name Is,” has inspired countless user-generated videos worldwide, including 2.1 million on TikTok as of May 2023.

Very few tech investors operate locally. Among them are angel investors, the Kazakhstani fund Most Ventures and Aga Khan’s Accelerate Prosperity. Recently, this nonprofit announced an acceleration program with $50,000 equity injections, in partnership with the United States Agency for International Development.

Some foreign tech companies have settled in Kyrgyzstan, including Alawar, EPAM, HH.ru and Hypha. Founded in 2020 by U.K. businessman Louis French, Hypha has hired a Kyrgyz team to develop a graph-based cloud app “for collective team intelligence.”

Tajikistan: First steps toward tech innovation

Tajikistan is behind most of its Central Asia neighbors in terms of digitalization, IT outsourcing and a startup ecosystem. The country is taking steps in the right direction, however.

Since 2018, the State Business Incubator — which is now established in five cities within the country — offers an array of support services to entrepreneurs, including those working in tech. Local startups may also get support from international organizations such as the UNDP, Germany’s GIZ, the Japan International Cooperation Agency, USAID and Accelerate Prosperity.

A state-backed technology park is under construction in Dushanbe, the capital city. Designed with support from the UNDP, its purpose is to develop Tajikistan’s IT capacities, accelerate startups and attract international tech companies to the country.

A few private investors operate in Tajikistan. One of them is FiftyFive Group, a multifaceted investment and management company that is behind the country’s main online travel agency, Fly.tj, and aims to develop new ventures.

There are only a few angel investors in the country — who generally have limited experience and no venture funds yet. The local legislation has yet to be adapted for such activity to emerge.

Top Tajik startups include:

- DocMed, an online medical appointment platform that operates domestically;

- FiftyFive Group‘s FlySoft, which has begun selling its air ticket booking solutions across the region; and

- Zypl.ai, which has developed “a SaaS fintech startup deploying machine learning to advance microfinance.”

Zypl.ai is the startup pride of the nation. Founded in 2021 by Azizjon Azimi, a Tajik entrepreneur who has degrees from Stanford and Harvard, this startup has attracted funding from foreign investors. These include Aloqa Ventures (Uzbekistan), Battery Road Digital Holdings (India) and Presto Ventures (Czech Republic) through a $1.1 million pre-seed round in September 2022; as well as TumarVC (Kazakhstan), which provided funding in early 2023.

Tajikistan is also home to a fintech and e-commerce company called Alif. Founded in 2014, it has expanded to Uzbekistan and the UAE, and is now eyeing new markets in the Middle East and Asia. In September 2021, Alif completed a Series A round, raising $8 million in equity and $50 million in debt at a valuation exceeding $100 million.

Turkmenistan: A handful of pioneers

The least open country in the region, Turkmenistan is also the least developed in terms of tech innovation.

A few initiatives have emerged over the past few years, however. Launched in 2020 with support from USAID, along with the local Academy of Sciences, Startup Academy has incubated around 70 young companies, which include a growing number of tech startups.

Startup Academy has also launched a business angel club. No deals have been made so far, but Turkmen aspiring investors can enjoy a series of EBRD-backed seminars.

While local legislation has yet to be adapted for startup and venture activity, no state support program has been launched so far. However, the government is considering taking steps in that direction, with discussions currently revolving around a potential “agency for innovation development.”

Notable startups in Turkmenistan include:

A handful of Turkmen founders operate startups abroad. These include the Freezone app, which started in Russia but reportedly has plans to move to another jurisdiction; and KinesteX, which has its headquarters in Dubai and a team in Turkmenistan.

“Startup culture is virtually nonexistent in Turkmenistan,” said a local businessman. “The very notion of a startup is too recent and little-known, and neither the legislation nor the infrastructure is ready.”

Local IT outsourcing is embryonic, too — but IT education has been developing fast recently. Many universities host IT faculties, while domestic and foreign IT courses are growingly available.

Central Asian startups on the global stage

While many Central Asian startups operate domestically — from e-commerce, to delivery, to financial, to medical — others are geared toward foreign markets.

“A startup that stays in the country is unlikely to make a 1,000x return,” said Asror Arabjanov, a Stanford law grad corporate lawyer from Uzbekistan.

Many of these globally minded startups target the U.S. market — which is also the case for a number of their peers from Russia, Ukraine, Belarus and other former Soviet Union countries. A significant number target the Middle East and Asia, which they feel are more accessible geographically and perhaps culturally. Europe is a rarer destination. Russia, which used to be a natural first step for many Central Asian startups, has lost much of its appeal because of its war with Ukraine and the subsequent international sanctions.

Several international acceleration programs were launched recently to support startups in Central Asia. These include the EBRD’s Star Venture (Kazakhstan, with planned extension to other countries of the region), Plug and Play (Kazakhstan, Uzbekistan) and Google for Startups (Kazakhstan).

10 internationally oriented startups born in Central Asia

| Startup | Origin | Solution | Investments | International |

| CitiX | Kazakhstan | Digital outdoor advertising and city information | $3 million from a local investor | First foreign sales in Turkey, expansion plans for the UAE, Saudi Arabia and U.S. |

| Clockster | Kazakhstan | Staff management and business automation | $1.5 million from local and international investors | HQ and traction in Indonesia |

| D Billions | Kyrgyzstan | Kids’ entertainment video content | N/A | Global traction (31 billion views on YouTube) |

| Growave | Kyrgyzstan | Marketing platform for small and medium-sized Shopify brands | N/A | Reports 13,000 customers across the world |

| Iman Invest | Uzbekistan | Halal finance solution | $1 million from local and international investors | Aims to attract 1 billion users worldwide |

| Jet | Kazakhstan | E-scooter rental service | $3 million from local investors | Active in six countries in Central Asia and Eastern Europe |

| Kodif.io | Kyrgyzstan | Low-code platform for scalable CX automations | $3.1 million from international investors | HQ in California |

| Parqour | Kazakhstan | Smart parking | $5 million injected or committed from a local investor | Sales in the U.S., Middle East, Southeast Asia, Europe; in the process of moving HQ to the U.S. |

| S1lkPay | Kazakhstan | Financial services company that specializes in mobile banking | $7.3 million from undisclosed investors | HQ in Dubai, first projects in Middle East and Africa |

| Zypl.ai | Tajikistan | SaaS fintech startup deploying machine learning | $1.1 million from Central Asian and international investors | Active in several countries within Central Asia and the Middle East |

Some Central Asian entrepreneurs have founded or co-founded their companies abroad — sometimes without any ties to their country of origin. Examples of successful projects include:

- U.K.-based Behavox, which has raised more than $120 million to develop its AI-driven platform for corporate data analysis;

- U.S. HR tech startup Celential, which secured $9.5 million;

- U.K. fintech DNA Payments, which has raised 100 million pounds ($124.35 million) and acquired several companies; and

- U.S.-based Honorlock, which provides proctoring services for colleges and universities, and raised $40.7 million.

(More of these success stories can be read here.)

Some of these founders find support from local diasporas. For example, “Many entrepreneurs from Central Asia — as well as other parts of the former Soviet Union — operate in the U.S. transportation industry, especially long-haul commercial trucking. Uzbeks own fleets in all categories, from a few trucks to hundreds or thousands,” said Arabjanov.

“These Uzbek-founded U.S. trucking companies outsource their work to BPO companies in Uzbekistan,” he said. “They even generate demand for IT products, especially transport management systems and workforce automation — stimulating startup activity in this field.”

Arabjanov is the founder of datatruck, a U.S. company that develops a workforce automation platform for trucking companies.

International VCs in Central Asia

International investors are much less active in Central Asia than in other emerging areas such as Africa, India or Latin America. The reasons include the small number of internationally viable startups, the lack of infrastructure and adapted legal framework — particularly in Tajikistan and Turkmenistan — and, simply, the lack of information and awareness about a region that usually slips under the radar.

Here are notable international firms investing in Central Asia:

- Baring Vostok, a major U.S.-managed private equity/VC fund that was based in Moscow until recently. As seen above, this fund backed Kazakhstan’s Kaspi Bank in its early days — about 13 years before its London IPO. Baring Vostok also invested in classifieds platforms Kolesa.kz ($15 million in 2014), Krysha.kz and Market.kz.

- Battery Road Digital Holdings, headquartered in Mumbai, India. While owning a stake in Zypl.ai (Tajikistan) and Iman Invest (Uzbekistan), this fund might not continue backing Central Asian startups due to its new focus on private equity investments, an industry insider said.

- Big Sky Capital, established in Singapore by Kazakhstani VC Adil Nurgozhin, this firm is still investing in Kazakhstan (Clockster, Kwaaka).

- Quest Ventures, another Singapore-based fund, has stakes in Billz.io (Uzbekistan), Cerebra, Clockster and 1Fit (Kazakhstan).

- Sturgeon Capital, a U.K.-based $275 million private equity/VC fund targeting “frontier markets” — including Central Asia, Egypt, Bangladesh and Pakistan — where they see a “$300 billion opportunity.” This fund has made a few investments in Uzbekistan since 2019, focusing on e-commerce and fintech projects with an international dimension. They are now raising a new fund with a $50 million target to invest specifically in Uzbekistan and other Central Asian countries.

- Tesla Capital, an impact fund from Singapore with stakes in Clockster, CTOgram, Smart Satu, Toidriver, Uvu (Kazakhstan) and Iman (Uzbekistan).

- TUZ Ventures, backed by a Mongolian businessman who wants to “unlock Central Asia” and the Caucasus. However, the company’s activity has been less noticeable in the past years.

- 500 Global has supported several startups from the region (e.g. Clockster, Iman, One App and TASS Vision).

Some other foreign funds have been involved occasionally (e.g. Singapore-based funds Le Mercier and MyAsia VC backing Iman Invest; Dutch business angel Bas Godska investing in Chocolife).

What to expect next

Even though startup and venture activity is still very modest in these countries, Kazakhstan, Uzbekistan and Kyrgyzstan (despite the latter’s modest size) could emerge tomorrow as new hot spots on the global scene.

“This is a frontier market in the sense that a lot of things are not fully developed and digitized yet. Hence there are a lot of opportunities to build truly vertically integrated projects,” said Bakhtiyar Kubessov, CBDO at Citix. “Couple this with a pretty high level of education in several countries of the region, and you could get a hub for technological companies.”

“This is a frontier market in the sense that a lot of things are not fully developed and digitized yet. Hence there are a lot of opportunities to build truly vertically integrated projects. Couple this with a pretty high level of education in several countries of the region, and you could get a hub for technological companies.”

-Bakhtiyar Kubessov, CBDO at Citix

Pavel Koktyshev, managing partner at Most, believes that “Central Asia has a high potential to attract international venture investors.” He highlights specific niches such as technology and digitalization, agriculture and agritech, eco-tourism and renewable energy for rural areas as industries with a lot of potential.

Development finance institutions have already stepped in. ADB Ventures, the EU, GIZ, USAID, UNDP, World Bank and others are involved in a variety of programs that aim to support sustainable economic growth through technology development. After studying the region’s potential thoroughly, World Bank affiliate IFC is open to backing new, locally-focused venture funds.

While a pioneer like Sturgeon Capital is raising new funds, several international VCs are eyeing the region. Recent examples include a leading Western fund manager, who sees an “exceptional investment opportunity” in the “fast-emerging Eurasian tech ecosystem.”

While addressing “a fundamental market dislocation in the region — insufficient venture funding and mentorship from experienced VCs in growing high velocity, scalable companies,” the considered new fund would “build a bridge” to the most advanced markets.

Investing in Central Asia might indeed be a good bet, provided that the region remains resilient to the geopolitical turbulence that surrounds it.

*In addition to the people quoted above, Alim Hamitov (Most Ventures), Amirkhan Omarov (Parqour), and Bekzod Sobirov (Uzbekistan expert), as well as Accelerate Prosperity, Astana Hub, digitalbusiness.kz, EBRD, IFC and IT Park Uzbekistan provided information for this overview.

Adrien Henni has more than a decade of venture and startup experience in Eastern Europe and Central Asia. He is the founder of International Digital News, a tech news and market research agency covering these regions, and is an adviser to a variety of startups and investors. These include DocMed, FiftyFive Group and Parqour, which are cited in this article and located in Central Asia.

https://about.crunchbase.com/topics/crunchbase-partnerships/