«We can optimize transportation costs by up to 50%»

— What is Relog?

— It is a route optimization system that includes online monitoring of drivers and couriers. We offer comprehensive statistics and delivery analysis, assisting companies in optimizing transportation costs (up to 50%), decreasing the car fleet (up to 20%), and minimizing customer dissatisfaction through timely deliveries. With our software, companies can potentially boost sales by up to 15%.

— How are these results attained?

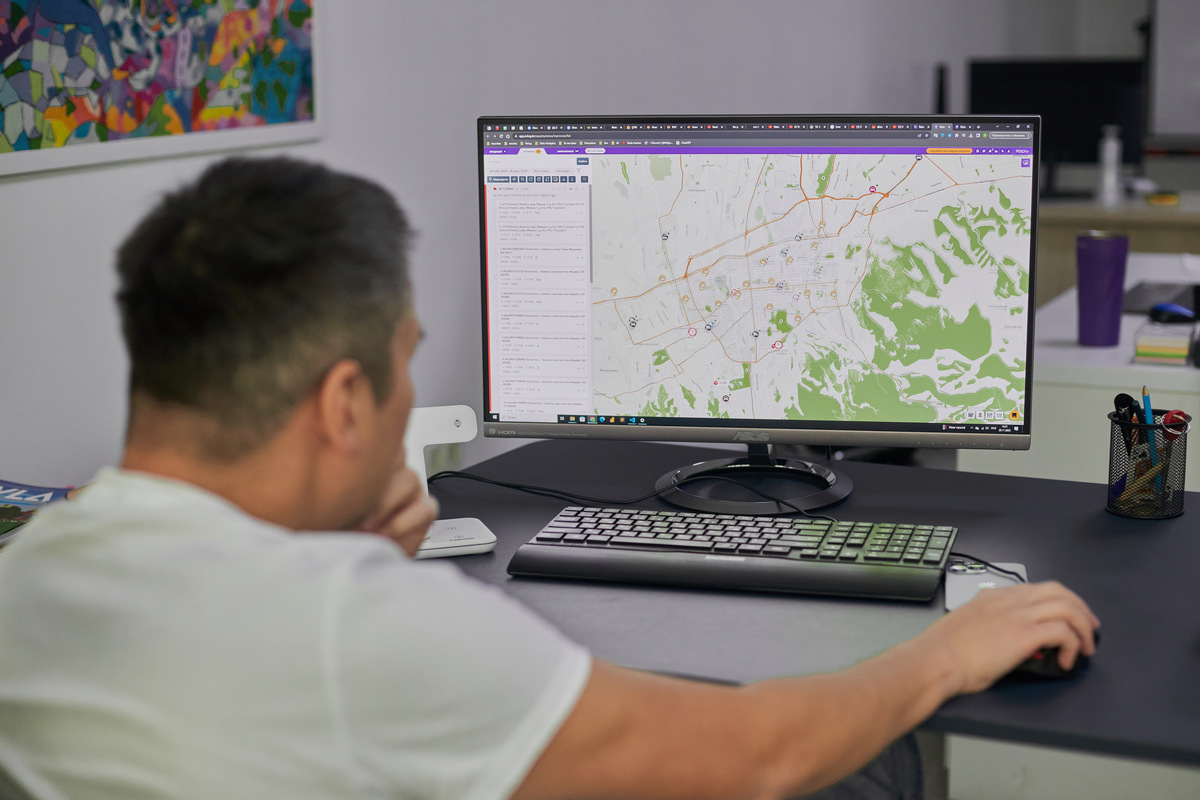

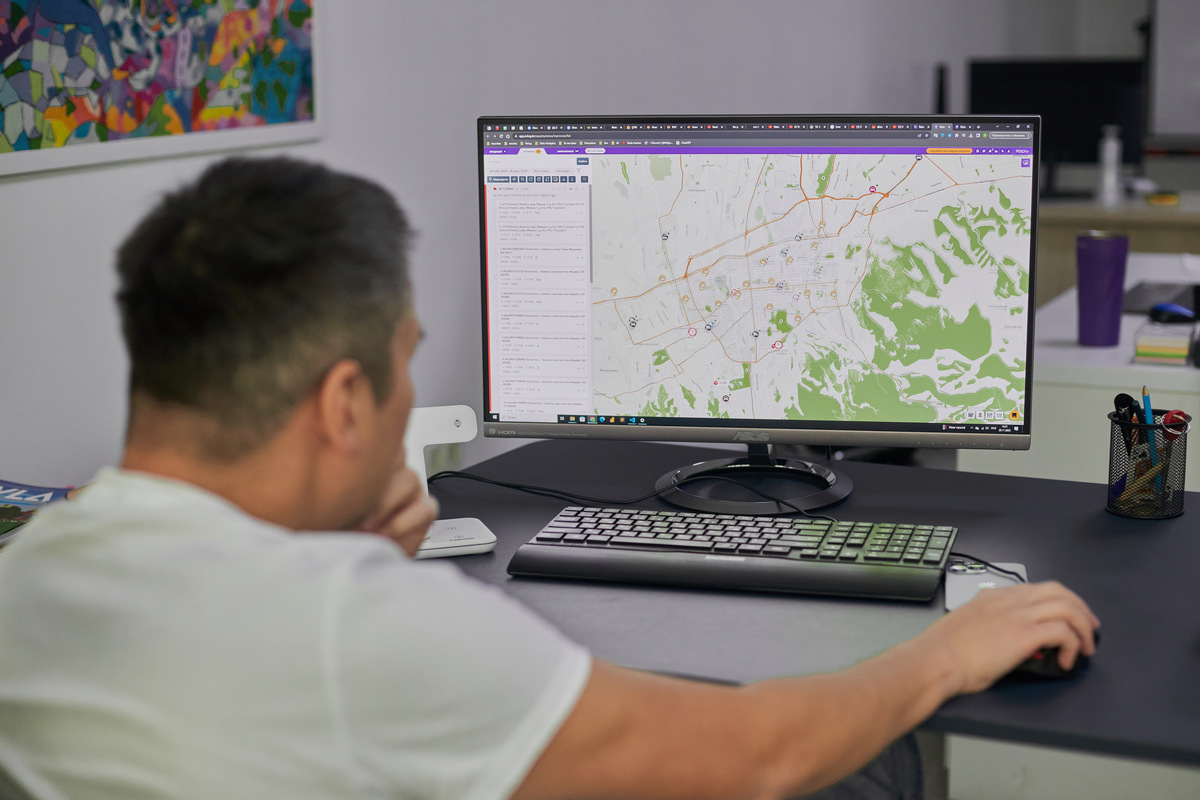

— I’ll illustrate with an example. Suppose you have a fleet of 50 or 100 cars. Our system facilitates seamless control and monitoring of all logistics, achieved through the implementation of the route planning algorithm.

Consider PepsiCo, which delivers 2-3 thousand orders daily in Almaty. Without our software, they would manually allocate orders to vehicles, create routes for each driver, or instruct them to choose their preferred route.

Relog automates the order processing, assisting in the calculation of the optimal number of cars to use. The program constructs the most efficient route, minimizing travel time and ensuring timely arrivals at the final destination. Consequently, the occurrence of delays to clients is reduced by 6-7 times. For instance, in scenarios where companies require goods to be delivered within specific time slots, such as bakeries delivering fresh bread promptly, the software proves instrumental in meeting these requirements.

In essence, the Relog algorithm encompasses over 40 parameters and multiple optimization targets. Users can minimize transport, travel time, or overall time. Additionally, we offer extensive analytical dashboards, branding this product as Relog BI. This enables managers to analyze each driver’s effectiveness, establish KPIs, and review feedback. The tool aids in identifying operational challenges and understanding areas that require improvement. This service is actively embraced by large companies, boasting a remarkable retention rate of 90%.

— Can you provide more details regarding the algorithms employed in your system?

— We operate with multiple functioning engines known as Thor and Neo, each with its unique characteristics and numerous optimization calculations. For instance, when faced with a thousand orders, the algorithm determines the required number of cars and their types (Gazel, Largus, or a five-ton vehicle).

— What additional features do you envision implementing in the product?

— We are considering incorporating elements of generative artificial intelligence, specifically large language models (LLM), into our product. In the near future, we plan to roll out updates that integrate AI-related features.

— Is it possible to find specialized professionals for working with such technology in Kazakhstan?

— There are challenges in this regard. While there is an ample supply of junior staff with expertise in machine learning, the number of senior specialists is limited. Consequently, we often need to seek such professionals in other countries. Last year, for instance, we invited a senior data scientist from the Moscow office of Sberbank. He collaborated with us for approximately nine months before moving on to join Facebook. Despite the difficulties, we are actively working to address these staffing challenges.

— How?

— The cornerstone solution lies in education. We’ve dedicated considerable effort to our team, investing significant time and resources. Initially, we started with a limited pool of IT specialists. Expanding this pool necessitated training numerous qualified professionals who could work, gain expertise, and competence, and eventually launch their own products.

In essence, there is a need for an increased presence of programming studies in comprehensive schools, the establishment of private schools, and the provision of more grants for technical studies at universities. Achieving this goal demands substantial investments in education.

«The absence of high-quality infrastructure leads to delays in arrivals, order refusals, and a decline in clients’ loyalty»

— How would you define intracity megapolis logistics in Kazakhstan?

— It comprises various transportation types, starting with B2B transportation. This involves distributors from major trading companies delivering goods to other businesses, such as retail outlets or for specific deliveries. Examples include FMCG distributors, e-commerce, and the pharmaceutical industry, among others.

The second type is B2C delivery, which involves courier services and internet shops delivering goods directly to final customers. For instance, Sulpak provides the delivery of electronic products to customers. B2C delivery often includes express options, particularly in the realm of food delivery from restaurants. Over the past two years, several robust players have entered this niche, securing strong positions in the market.

— In the past years, how has the digitization of maps improved in terms of quality in Kazakhstan?

— In major cities, the maps are well-developed. Both Yandex and 2GIS excel in this area, employing dedicated teams that actively enhance and update the maps.

We utilize various maps, including Google and 2GIS. While 2GIS offers good quality, it primarily focuses on digitizing cities with populations exceeding 200,000, and even in those cities, the maps may not always be entirely accurate. For instance, there are challenges in Taraz and Kyzylorda. To address these issues, we’ve developed our own mapping engine and integrate it with those requested by the client.

— What additional challenges does intracity logistics face in our country?

— These challenges are tied to infrastructure. The scarcity of parking spaces, coupled with limited construction, poses a hurdle. Traffic jams further exacerbate the situation, and there are concerns regarding the quality of roads. For instance, the road surface after Tole bi street in Almaty is in poor condition. All these factors impact logistics, resulting in delayed arrivals, order refusals, diminished client loyalty, increased costs, and more. Relog is dedicated to addressing and resolving these issues.

— Who is your primary competitor?

— Primarily, Yandex has remained active, while other players have gradually diminished their activity or ceased operations altogether. Surprisingly, Yandex has become more engaged, despite initial expectations of a longer recovery period.

I initially believed that B2B-SaaS was not a priority for them, given their focus on the B2C segment where they possess extensive expertise. However, the company is now making significant investments in Yandex.Routing.

— Have you considered venturing into a courier service for individual clients?

— Absolutely, not. Numerous courier services emerge and cease operations every month. This market is highly competitive, especially if you’re not on the scale of companies like DHL and DPD, which operate on very low margins.

«Our revenue for the past year totaled around $1 million»

— Let’s discuss the economic aspects. What are the company’s value and profitability?

— Our Annual Recurring Revenue (ARR) for the year 2022 reached approximately $1 million.

Concerning the company’s valuation, Timur Turlov entered with an estimate of $12 million. Presently, we can anticipate a valuation of approximately $20-25 million. In just the past year, the company has grown approximately twofold.

Previously, immediate profitability was not a priority as we sought investments to fuel indicator growth. However, we achieved operational profit long ago. Our software boasts a high margin, exceeding 50%. Presently, the regular monthly income is around $80-85 thousand.

— How do you generate revenue from your software?

— We utilize a subscription-based model for monetizing our software. The subscription fee is determined by the number of cars in the company. For instance, companies with 10 cars are charged one fee, while those with 100 cars are charged a different fee. Annual subscriptions for small companies start at $100, and the highest-tier companies pay slightly over $10,000 per month.

— How did the startup successfully secure agreements with prominent clients such as PepsiCo, Coca-Cola, and Sulpak?

— The most challenging aspect of B2B is securing initial sales. Unfamiliar technological solutions pose high risks for companies. No one is willing to test a new product and jeopardize their business and client relationships. Trust is difficult to establish when there are no successful cases to showcase.

What steps did we take? Initially, we offered subscription plans on favorable terms to small companies. For instance, one of our first clients was a water delivery service, and we aimed to demonstrate the benefits of our solution to them. Once they experienced the advantages, they began recommending us to others. Through initially subscribing small companies, we gradually expanded our reach to larger businesses.

With PepsiCo or Sulpak, we initiated our collaboration by implementing our solution in one of their branches in Almaty. Subsequently, we expanded our services across Kazakhstan.

— In which markets is Relog currently operational?

— Currently, our primary market is Kazakhstan, accounting for 60% of our business. Following closely is Russia, comprising a 30% share. We have notable clients in Russia, including Vkusvill and Renna Holding.

The remaining 10% is allocated to other post-Soviet countries, including Uzbekistan, Ukraine, Belarus, and Tajikistan. Our client portfolio spans over 300 companies.

Regarding further expansion, all our sales plans are directed towards the CIS countries. We aim to capture a significant portion of this market, recognizing substantial growth opportunities within it.

In the previous year, we ventured into the Polish market, establishing a dedicated team. Upon entering, we secured contracts but realized that the endeavor proved to be quite expensive. Starting a business there required building everything from the ground up.

— How challenging was it to initiate operations in Belarus and other Central Asian countries?

— With our cloud-based product, we can conduct sales remotely across the CIS region from Almaty.

Starting in 2017 posed more challenges as companies were initially hesitant to finalize contracts and negotiations remotely. However, over time, we played a pivotal role in training the market, leading to many companies now comfortably conducting all processes remotely. Every contract, including those with major corporations like PepsiCo and Renna Holding, has been signed remotely.

«Engaging with B2G entities poses challenges»

— Let’s delve into the topic of collaborating with B2G. Earlier this year, you posted on Facebook, mentioning that Kazpost ignored Relog and showed reluctance to work with you. What is the current status of the situation?

— First and foremost, I need to clarify why I shared that post. To be honest, it has always saddened me that despite our efforts, instead of supporting a Kazakhstani company, they opt to acquire technologies from Yandex. I believe this is not the right approach.

Subsequently, negotiations were initiated, and we had meetings with the relevant minister, Bagdat Musin, and Asel Zhanasova, the chairman of the board of Kazpost JSC. We conducted two pilot projects with Kazpost, demonstrating our competence and advantages. The management expressed satisfaction with the results. However, the contract has not been signed yet.

The challenge lies in dealing with Kazpost’s tender processes and other bureaucratic nuances. I remain hopeful that everything will be resolved next year. Overall, engaging with B2G entities poses difficulties.

— If an agreement is ultimately reached with Kazpost, what will the nature of your cooperation be like?

— It would be an EMS partnership, essentially a courier service. Considering their extensive letter deliveries, it presents the first area where our services can be beneficial. Additionally, Kazpost has a function engaged in intercity and international deliveries, and we can offer assistance in those areas too.

— You previously mentioned challenging negotiations with Tartyp JSC, a quasi-state company involved in waste collection and removal. Have there been any developments in the situation?

— We initiated a paid pilot with them in Almaty, employing several cars for now. I must acknowledge that negotiations were challenging, but with changes in management, they began to pay attention to us, and the work has commenced.

— What other challenges did you encounter?

— Numerous challenges arose during the team formation, including hiring individuals who weren’t the best fit and issues with staff training. Financial planning also presented challenges, and until it is finely tuned, accurate forecasts will be elusive. Additionally, we made two unsuccessful forays into external markets where we invested funds but didn’t generate returns. However, these experiences contribute to our ongoing progress.

«We can optimize transportation costs by up to 50%»

— What is Relog?

— It is a route optimization system that includes online monitoring of drivers and couriers. We offer comprehensive statistics and delivery analysis, assisting companies in optimizing transportation costs (up to 50%), decreasing the car fleet (up to 20%), and minimizing customer dissatisfaction through timely deliveries. With our software, companies can potentially boost sales by up to 15%.

— How are these results attained?

— I’ll illustrate with an example. Suppose you have a fleet of 50 or 100 cars. Our system facilitates seamless control and monitoring of all logistics, achieved through the implementation of the route planning algorithm.

Consider PepsiCo, which delivers 2-3 thousand orders daily in Almaty. Without our software, they would manually allocate orders to vehicles, create routes for each driver, or instruct them to choose their preferred route.

Relog automates the order processing, assisting in the calculation of the optimal number of cars to use. The program constructs the most efficient route, minimizing travel time and ensuring timely arrivals at the final destination. Consequently, the occurrence of delays to clients is reduced by 6-7 times. For instance, in scenarios where companies require goods to be delivered within specific time slots, such as bakeries delivering fresh bread promptly, the software proves instrumental in meeting these requirements.

In essence, the Relog algorithm encompasses over 40 parameters and multiple optimization targets. Users can minimize transport, travel time, or overall time. Additionally, we offer extensive analytical dashboards, branding this product as Relog BI. This enables managers to analyze each driver’s effectiveness, establish KPIs, and review feedback. The tool aids in identifying operational challenges and understanding areas that require improvement. This service is actively embraced by large companies, boasting a remarkable retention rate of 90%.

— Can you provide more details regarding the algorithms employed in your system?

— We operate with multiple functioning engines known as Thor and Neo, each with its unique characteristics and numerous optimization calculations. For instance, when faced with a thousand orders, the algorithm determines the required number of cars and their types (Gazel, Largus, or a five-ton vehicle).

— What additional features do you envision implementing in the product?

— We are considering incorporating elements of generative artificial intelligence, specifically large language models (LLM), into our product. In the near future, we plan to roll out updates that integrate AI-related features.

— Is it possible to find specialized professionals for working with such technology in Kazakhstan?

— There are challenges in this regard. While there is an ample supply of junior staff with expertise in machine learning, the number of senior specialists is limited. Consequently, we often need to seek such professionals in other countries. Last year, for instance, we invited a senior data scientist from the Moscow office of Sberbank. He collaborated with us for approximately nine months before moving on to join Facebook. Despite the difficulties, we are actively working to address these staffing challenges.

— How?

— The cornerstone solution lies in education. We’ve dedicated considerable effort to our team, investing significant time and resources. Initially, we started with a limited pool of IT specialists. Expanding this pool necessitated training numerous qualified professionals who could work, gain expertise, and competence, and eventually launch their own products.

In essence, there is a need for an increased presence of programming studies in comprehensive schools, the establishment of private schools, and the provision of more grants for technical studies at universities. Achieving this goal demands substantial investments in education.

«The absence of high-quality infrastructure leads to delays in arrivals, order refusals, and a decline in clients’ loyalty»

— How would you define intracity megapolis logistics in Kazakhstan?

— It comprises various transportation types, starting with B2B transportation. This involves distributors from major trading companies delivering goods to other businesses, such as retail outlets or for specific deliveries. Examples include FMCG distributors, e-commerce, and the pharmaceutical industry, among others.

The second type is B2C delivery, which involves courier services and internet shops delivering goods directly to final customers. For instance, Sulpak provides the delivery of electronic products to customers. B2C delivery often includes express options, particularly in the realm of food delivery from restaurants. Over the past two years, several robust players have entered this niche, securing strong positions in the market.

— In the past years, how has the digitization of maps improved in terms of quality in Kazakhstan?

— In major cities, the maps are well-developed. Both Yandex and 2GIS excel in this area, employing dedicated teams that actively enhance and update the maps.

We utilize various maps, including Google and 2GIS. While 2GIS offers good quality, it primarily focuses on digitizing cities with populations exceeding 200,000, and even in those cities, the maps may not always be entirely accurate. For instance, there are challenges in Taraz and Kyzylorda. To address these issues, we’ve developed our own mapping engine and integrate it with those requested by the client.

— What additional challenges does intracity logistics face in our country?

— These challenges are tied to infrastructure. The scarcity of parking spaces, coupled with limited construction, poses a hurdle. Traffic jams further exacerbate the situation, and there are concerns regarding the quality of roads. For instance, the road surface after Tole bi street in Almaty is in poor condition. All these factors impact logistics, resulting in delayed arrivals, order refusals, diminished client loyalty, increased costs, and more. Relog is dedicated to addressing and resolving these issues.

— Who is your primary competitor?

— Primarily, Yandex has remained active, while other players have gradually diminished their activity or ceased operations altogether. Surprisingly, Yandex has become more engaged, despite initial expectations of a longer recovery period.

I initially believed that B2B-SaaS was not a priority for them, given their focus on the B2C segment where they possess extensive expertise. However, the company is now making significant investments in Yandex.Routing.

— Have you considered venturing into a courier service for individual clients?

— Absolutely, not. Numerous courier services emerge and cease operations every month. This market is highly competitive, especially if you’re not on the scale of companies like DHL and DPD, which operate on very low margins.

«Our revenue for the past year totaled around $1 million»

— Let’s discuss the economic aspects. What are the company’s value and profitability?

— Our Annual Recurring Revenue (ARR) for the year 2022 reached approximately $1 million.

Concerning the company’s valuation, Timur Turlov entered with an estimate of $12 million. Presently, we can anticipate a valuation of approximately $20-25 million. In just the past year, the company has grown approximately twofold.

Previously, immediate profitability was not a priority as we sought investments to fuel indicator growth. However, we achieved operational profit long ago. Our software boasts a high margin, exceeding 50%. Presently, the regular monthly income is around $80-85 thousand.

— How do you generate revenue from your software?

— We utilize a subscription-based model for monetizing our software. The subscription fee is determined by the number of cars in the company. For instance, companies with 10 cars are charged one fee, while those with 100 cars are charged a different fee. Annual subscriptions for small companies start at $100, and the highest-tier companies pay slightly over $10,000 per month.

— How did the startup successfully secure agreements with prominent clients such as PepsiCo, Coca-Cola, and Sulpak?

— The most challenging aspect of B2B is securing initial sales. Unfamiliar technological solutions pose high risks for companies. No one is willing to test a new product and jeopardize their business and client relationships. Trust is difficult to establish when there are no successful cases to showcase.

What steps did we take? Initially, we offered subscription plans on favorable terms to small companies. For instance, one of our first clients was a water delivery service, and we aimed to demonstrate the benefits of our solution to them. Once they experienced the advantages, they began recommending us to others. Through initially subscribing small companies, we gradually expanded our reach to larger businesses.

With PepsiCo or Sulpak, we initiated our collaboration by implementing our solution in one of their branches in Almaty. Subsequently, we expanded our services across Kazakhstan.

— In which markets is Relog currently operational?

— Currently, our primary market is Kazakhstan, accounting for 60% of our business. Following closely is Russia, comprising a 30% share. We have notable clients in Russia, including Vkusvill and Renna Holding.

The remaining 10% is allocated to other post-Soviet countries, including Uzbekistan, Ukraine, Belarus, and Tajikistan. Our client portfolio spans over 300 companies.

Regarding further expansion, all our sales plans are directed towards the CIS countries. We aim to capture a significant portion of this market, recognizing substantial growth opportunities within it.

In the previous year, we ventured into the Polish market, establishing a dedicated team. Upon entering, we secured contracts but realized that the endeavor proved to be quite expensive. Starting a business there required building everything from the ground up.

— How challenging was it to initiate operations in Belarus and other Central Asian countries?

— With our cloud-based product, we can conduct sales remotely across the CIS region from Almaty.

Starting in 2017 posed more challenges as companies were initially hesitant to finalize contracts and negotiations remotely. However, over time, we played a pivotal role in training the market, leading to many companies now comfortably conducting all processes remotely. Every contract, including those with major corporations like PepsiCo and Renna Holding, has been signed remotely.

«Engaging with B2G entities poses challenges»

— Let’s delve into the topic of collaborating with B2G. Earlier this year, you posted on Facebook, mentioning that Kazpost ignored Relog and showed reluctance to work with you. What is the current status of the situation?

— First and foremost, I need to clarify why I shared that post. To be honest, it has always saddened me that despite our efforts, instead of supporting a Kazakhstani company, they opt to acquire technologies from Yandex. I believe this is not the right approach.

Subsequently, negotiations were initiated, and we had meetings with the relevant minister, Bagdat Musin, and Asel Zhanasova, the chairman of the board of Kazpost JSC. We conducted two pilot projects with Kazpost, demonstrating our competence and advantages. The management expressed satisfaction with the results. However, the contract has not been signed yet.

The challenge lies in dealing with Kazpost’s tender processes and other bureaucratic nuances. I remain hopeful that everything will be resolved next year. Overall, engaging with B2G entities poses difficulties.

— If an agreement is ultimately reached with Kazpost, what will the nature of your cooperation be like?

— It would be an EMS partnership, essentially a courier service. Considering their extensive letter deliveries, it presents the first area where our services can be beneficial. Additionally, Kazpost has a function engaged in intercity and international deliveries, and we can offer assistance in those areas too.

— You previously mentioned challenging negotiations with Tartyp JSC, a quasi-state company involved in waste collection and removal. Have there been any developments in the situation?

— We initiated a paid pilot with them in Almaty, employing several cars for now. I must acknowledge that negotiations were challenging, but with changes in management, they began to pay attention to us, and the work has commenced.

— What other challenges did you encounter?

— Numerous challenges arose during the team formation, including hiring individuals who weren’t the best fit and issues with staff training. Financial planning also presented challenges, and until it is finely tuned, accurate forecasts will be elusive. Additionally, we made two unsuccessful forays into external markets where we invested funds but didn’t generate returns. However, these experiences contribute to our ongoing progress.